Slow Growth in GDP Cause for Concern

A seemingly unending national economic expansion and record low unemployment doesn’t seem to be giving New Jersey the same boost as surrounding states. The state’s economy appears strong now, but when policymakers continue to seek higher tax rates, it indicates all is not well. A look at the state’s latest Gross Domestic Product (GDP) figures add another reason to worry.

A seemingly unending national economic expansion and record low unemployment doesn’t seem to be giving New Jersey the same boost as surrounding states. The state’s economy appears strong now, but when policymakers continue to seek higher tax rates, it indicates all is not well. A look at the state’s latest Gross Domestic Product (GDP) figures add another reason to worry.

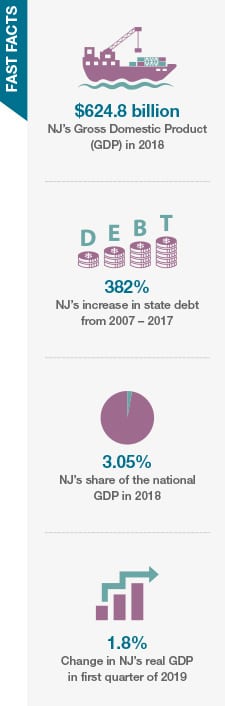

Meager Q1 Growth. New Jersey’s GDP grew a meager 1.8% in the first quarter of 2019, tied with Maryland for last in our seven-stateregion. By comparison, Delaware and New York’s GDP grew more than twice as fast (3.9% and 3.8% respectively), and Pennsylvania’s GDP saw a healthy 2.9% boost. Nationally, the GDP grew 3.1%.

New Jersey produced almost $625 billion worth of goods and services in 2018, which is the eighth highest GDP in the nation and more than most countries. Regionally, New Jersey sits behind only New York and Pennsylvania in GDP size.

Signs of Economic Volatility. One quarter of weak growth by itself is not cause for alarm. But the fact is, New Jersey has lagged the nation in GDP growth for several years now. Its share of the national GDP has dropped from a 20-year peak of 3.55% in 2002 to 3.05% last year.

In addition, the state’s expenses and debt are growing faster than revenues. From 2007 to 2017 state expenses increased 45% and debt rose 382%. Meanwhile, state revenues increased by only 23%.

New Jersey also lags in key indicators that contribute to the economy, like the regional business climate and business growth.

All of this comes at a time when the U.S. is experiencing 10 years of economic growth, tying the record for the longest expansion in the country’s history. New Jersey’s slow GDP growth, astronomical debts and lagging business climate leave it with increased volatility as an inevitable economic downturn looms.

Policy Impact. During times of economic growth, states must prepare for the next inevitable recession by fixing structural imbalances within the state budget.

Under the Murphy administration, the state has increased the corporate business tax rate, the top income tax rate and the minimum wage, expanded paid family leave, implemented paid sick leave, and enacted numerous business mandates. Furthermore, the Grow NJ and the Economic Growth and Redevelopment programs both expired June 30, leaving New Jersey without incentives to attract and retain companies and create jobs.

These policies are slowing New Jersey’s economic growth and are increasing the state’s volatility as an inevitable recession looms.